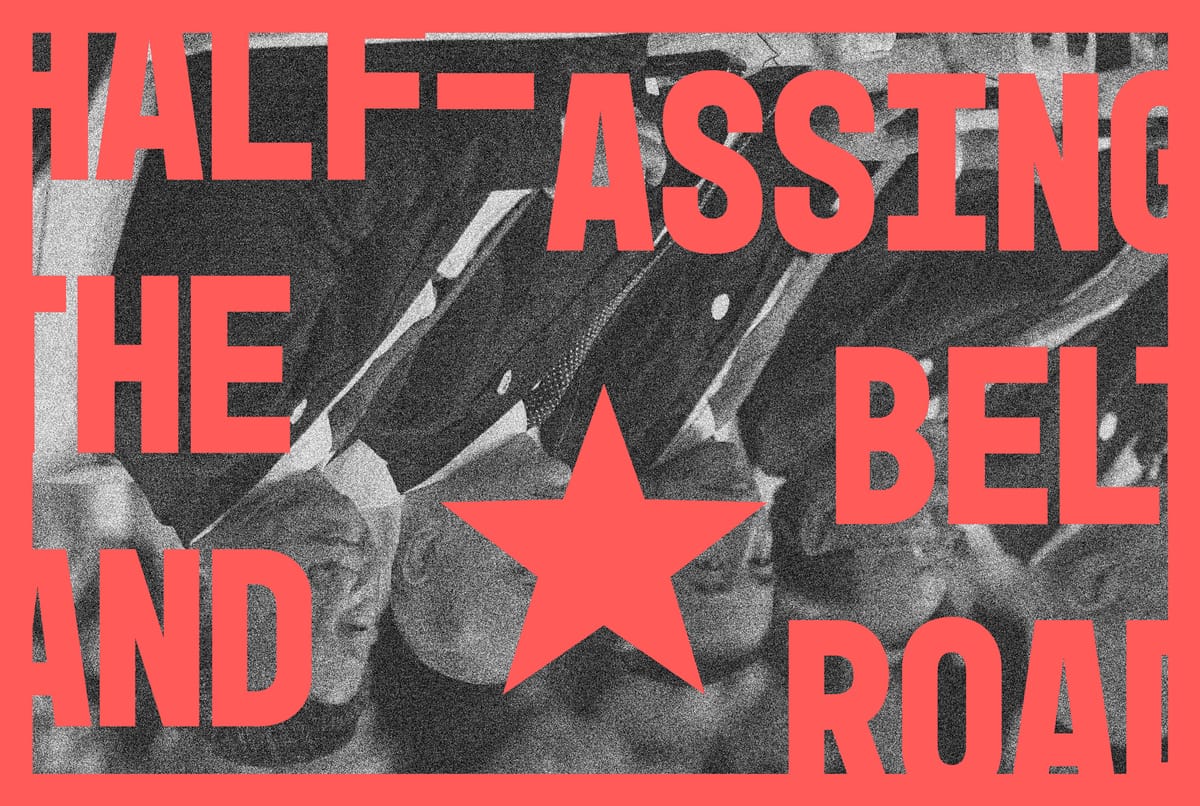

Half-Assing the Belt & Road

The Belt and Road Initiative was pitched by Xi Jinping as “the project of the century.” Ten years in, it has hardly lived up to the hype. What happened?

In 2013, newly ascended Chinese president Xi Jinping took the stage on an official visit to Kazakhstan and announced the Silk Road Economic Belt. Drawing upon two-thousand years of Chinese history, Xi declared that it was time to bring back the ancient Silk Road’s history of international friendship. A month later at the Indonesian parliament, Xi announced plans for the 21st Century Maritime Silk Road, a network of maritime trade routes that would create trade networks across Southeast Asia, Europe, and Africa.

Together, the land-based Economic Belt and maritime Silk Road form The Belt and Road Initiative (BRI), one of the most ambitious international infrastructure programs the world has ever seen. With a staggering portfolio of $1.3 trillion, the BRI has created hundreds of infrastructure projects throughout the world. The majority of the world’s nations—over 150—have signed onto the BRI’s awe-inspiring plan, which included six economic corridors that would create railways spanning the entire Eurasian continent from Rotterdam to Xi’an and sea routes from Fuzhou to Nairobi. The interconnectivity created by the BRI promised to be a model for win-win international cooperation by creating jobs, enhancing trade, and increasing cultural exchange across borders.

With such a grand vision, Xi declared that the BRI would be “the project of the century.” At the time, it seemed like a plausible claim. But a decade into the BRI, the program has turned out to be a chaotic mess. Plagued by corruption, labor violations, and debt unsustainability, it’s now clear that the BRI dream will not become a reality. Why did things go so wrong?

Marketing or Master Plan?

Given its bombacious title as “the project of the century,” one would imagine the BRI to be a well-coordinated program exemplary of the term “grand strategy.” Indeed, in the western imaginary, the Chinese are often thought to be capable of an efficiency and organization that eludes decadent western bureaucracies.

Despite this image as a disciplined, undivided party-state, the Chinese government is notoriously decentralized and fragmented. The Chinese state consists of a vast network of regional local governments that are themselves subdivided into several levels. While the public sector in western countries normally only includes a handful of firms, China’s public sector consists of over 150,000 state-owned enterprises (SOEs). The hundreds of thousands of organizations and sub-organizations that make up the Chinese state are headed by officials and managers whose promotions depend on their own organization’s success. Local government officials and SOE managers are thus incentivized to maximize the performance of their respective organizations, which often means outcompeting other Chinese state actors rather than thinking of the bigger nationwide picture. China has utilized this decentralized structure to great effect during the wildly successful reform and opening period. Competition amongst hundreds of local governments made the Chinese state a veritable laboratory for economic policy experimentation. As successful innovative policies emerged from the menagerie of experiments, they were then adopted by the rest of the country, and the local officials who came up with them received handsome promotions.

The Chinese state’s fragmentation is reflected also in the BRI. While a decentralized structure worked well for boosting growth rates, it hasn’t been so effective at coordinating a global infrastructure project. After the BRI’s splashy announcement, Beijing increased available funding for overseas infrastructure, but never followed up with concrete directives or proposals for specific projects. Xi sent a loud and clear message for more infrastructure, then left local Chinese officials and SOE managers to come up with the details themselves.

The BRI has been dangled as an attractive carrot of professional benefits for careerist local officials and SOE managers. The vast majority of BRI projects stipulate that work must be carried out by a Chinese SOE, which incentivizes individual SOE managers to use the BRI for their own gains. Local officials who could make their localities key BRI regions could receive promotions. These incentives led to a messy frenzy of project announcements. As BRI researcher Jonathan Hillman has described it, the BRI is “a gravy train without a conductor.”

The same dynamics of competition that drove the reform period thus also played out in the BRI, but with markedly worse results. While competition generated innovation in economic policy, it has led to inefficient races to the bottom for the BRI. Local governments entered bidding wars to bring BRI projects into their provinces, driving up subsidy offers that inflated project costs. It took years for Beijing to clamp down by consolidating railway projects under China Railway.

Beijing already has difficulty coordinating the enormous number of local governments and SOEs within China. When foreign actors are added to the mix, the possibility of central control goes out the window. Because of the massive breadth of the BRI, Chinese actors have to work in hundreds of wildly different political, ecological, and cultural environments. The foreign countries that Chinese actors are dealing with are also not monoliths. BRI participant countries have their own array of politicians, private businesses, and local residents, each trying to leverage BRI projects for their own interests. China’s central government simply doesn’t have the capacity to manage thousands of projects and balance the demands of tens of thousands of diverse actors, and thus has to rely on their poorly coordinated agents to figure things out.

This disorganization makes the BRI more style than substance. Merriden Varall has persuasively argued that the BRI is best understood as a brand rather than a plan: “The BRI is actually just a brand. It’s a marketing tool, a label applied with a sweeping generosity to a huge range of projects being undertaken by a vast array of actors.” The flexibility of this brand has allowed unrelated ventures like fashion shows, dentistry, and sports tourism to be included under the BRI umbrella. Many of the BRI’s most prominent projects were actually planned and started several years before the BRI was announced. The BRI label was simply slapped onto them afterwards to make the statistics more impressive and create the illusion that progress was quickly being made.

The buy-in of so many countries around the world must be understood within this focus on boosting the brand. Becoming a BRI country only requires signing a non-binding memorandum of understanding that entails no concrete commitments—a cost-free way to score diplomatic points with Beijing. The brand’s lack of an overall plan also makes it easy to include and exclude projects depending on their performance. In 2013, Xi visited Tanzania and pledged support for its $10 billion deepwater port project in Bagamoyo, worth a massive 22% of its GDP that year. The port and its high price tag promised to be a flagship BRI project to boost the brand. But when the project embarrassingly stalled out in its early planning phase, China peeled off its BRI sticker.

A decade into the BRI, there isn’t even an official BRI map or an authoritative list of BRI projects. Some may point to the maps of the BRI’s six economic corridors, but the six corridors have also turned out to be more marketing than master plan. A brief from the Center for Strategic and International Studies found that with the exception of the BRI’s flagship economic corridor, the China-Pakistan Economic Corridor, there was no significant relationship between corridor participation and higher amounts of project activity. Even in the Pakistan corridor, only a small amount of lending is for connectivity projects. The six corridors project a magisterial vision, but there’s little substance behind it.

All of this shows that the BRI is not the grand strategy that both supporters and critics portray it as. The BRI is simply a brand that ties together a messy mishmash of projects created from the bottom-up, not a centrally guided program looking to create a globally coordinated infrastructure network. The Chinese state’s fragmentation and disorganization forms the institutional foundation of the initiative—as well as its numerous problems.

Implementation Challenges

The rush to impress Beijing and secure financing for BRI projects led Chinese officials to frequently eschew risk analyses, feasibility studies, or environmental impact assessments. Dispersed Chinese managers and officials scrambling to come up with a BRI project often don’t have an understanding of what kind of infrastructure opportunities are available beyond China's borders. Thus, they heavily rely on foreign political leaders for sourcing project ideas. These political leaders have their own agendas, often looking to quickly build flashy megaprojects before re-election cycles. On the part of both Chinese actors and actors in loan recipient countries, there are substantial incentives to deprioritize long-term thinking on sustainable projects.

The poor planning behind the BRI has resulted in frequent implementation challenges. A study by AidData found that 35% of the value of Chinese BRI projects have suffered implementation problems due to corruption, labor unrest, ecological damage, underutilization, and more. Direct Chinese participation in project development has actually made implementation challenges more likely. When filtering for projects that have involved implementation by Chinese agencies, the problem rate rises to 44%. The AidData study also likely underestimates the percentage of implementation problems faced to date, as the dataset ends in 2017 and doesn’t capture cases where it has taken more years for projects’ (literal) cracks to show. Of the wide variety of implementation challenges, corruption, human and labor rights violations, and borrower country defaults stand out as the clearest evidence of the BRI’s shortcomings.

Corruption

Xi Jinping’s politically motivated, but nonetheless effective anti-corruption campaign has made great strides towards reducing corruption within China. No similar effort, however, has been made for the BRI.

Once again, decentralization, which makes BRI a breeding ground for corruption, is the issue. Chinese local government officials and SOE managers, eager to get a BRI project on their résumé, are likely to choose the path of least resistance by accepting the host country’s norms around greasing the wheels. Local elites in BRI recipient countries are well aware of this and know that their Chinese partners will give them a cut just to push the project through. Corrupt officials are provided additional cover by the BRI’s well-known opacity. After the BRI’s announcement, Chinese contracts began requiring confidentiality clauses, shielding them from scrutiny by journalists and academics. The absence of central regulation means that intervention from higher authorities is unlikely, while the opacity of deals makes local elites more confident that they can get away with their graft.

AidData found that Chinese overseas lending to countries with high corruption risk surged from 22% in 2013 to 61% in 2017. Another study of 30 African countries showed that corruption is much more likely to be prevalent around Chinese development sites. McKinsey’s study of eight African countries along the BRI found that 60% to 87% of Chinese companies used bribes to speed up BRI projects. In the case of Ecuador’s Coca Codo Sinclair hydroelectric plant (which is currently in disrepair), public prosecutors found that the project’s Chinese construction company distributed $76 million in bribes. A chief executive involved in Kazakhstan’s Astana Light Rail Project was accused of misappropriating project funds and fled the country, leading to the suspension of the project. In the infamous case of Sri Lanka’s Hambantota Port, Chinese construction funds were embezzled for Mahinda Rajapaksa’s failed re-election campaign.

It’s possible, of course, to be overly moralistic about bribing norms; sometimes it’s simply how things get done. But it’s clear in the case of BRI projects that the social benefits are being drastically reduced by graft.

Labor and Human Rights

A study of 149 countries by Marketea Jarabek found that there are decreased levels of human rights and democracy after the implementation of BRI projects, including a decrease in freedom from forced labor. A 2021 report from the Business and Human Rights Resource Centre found that Chinese overseas business activities were linked to 679 allegations of human rights abuses, spanning across labor rights violations, land rights abuses, and beatings and violence. The report also finds a positive correlation between Chinese investments and an increase in human rights violations. The response to these allegations has mostly been to keep quiet and hope things blow over, with a response rate of only 24% from Chinese businesses.

In their new book, Belt and Road: The First Decade, Igor Rogelja and Konstantinos Tsimonis offer two case studies of labor rights violations in Serbia and Greece. In 2018, Chinese tire manufacturer Linglong announced its plans to build a manufacturing plant in Serbia. Linglong brought in Vietnamese workers to build the plant and subjected them to conditions so horrific that they’d make Jeff Bezos blush. Workers were forced into dilapidated shacks without clean running water and heating. Only two rundown bathrooms were provided for the hundreds of Vietnamese workers at the site. Food provision was so limited that workers resorted to using traps to catch small animals to eat. Workers who wanted to return home before the end of their contracts couldn’t even leave because their passports had been confiscated by Linglong managers. After these human rights violations began attracting international scrutiny, Linglong fired a worker who spoke to the media and shoved workers in front of TV cameras to testify about how wonderful their jobs were.

Greece’s port in Piraeus is a darling child of Chinese state media’s BRI propaganda, frequently propped up as an ideal BRI project that has increased economic activity and generated profits. While there is no doubt of its financial success, China’s handling of the port came straight out of the neoliberal playbook. Against the opposition of labor unions, the Chinese shipping firm, COSCO, began its first phase of the Piraeus port’s privatization in 2009. Immediately afterwards, 500 permanent employees covered under collective bargaining agreements were sacked and replaced by contingent subcontractors. These subcontractors often worked sixteen-hour shifts on zero-hour contracts. Safety standards were ignored, leading to a number of fatal accidents. When these working conditions led to a series of strikes in 2014, COSCO refused direct negotiations until they were forced to the bargaining table by significant disruptions in port operations. Today, wages still remain low, and workers strike almost annually for better conditions.

Even if the BRI were a more organized infrastructure program, it certainly wouldn’t be a socialist one. Firms owned by the Communist Chinese state brutalize workers with the same zeal as private companies in capitalist countries. When it comes to labor, the BRI offers nothing for the labor-Left to aspire to.

Debt Troubles

BRI projects don’t come cheap. For the BRI’s developing countries, a single project can cost a double-digit percentage of annual GDP. Project costs are inflated by China’s financial goals for the BRI. China always intended to make a profit from the BRI, and each Chinese participant needs its cut. Chinese construction SOEs need to profit abroad because of China’s heavily oversaturated domestic infrastructure market. Chinese banks, also seeking to turn a profit, have provided almost no grants and given out loans at relatively high interest rates with an average of 6%.

All of this combined with the BRI’s poor long-term planning have created a recipe for unsustainable debts for BRI debtor countries. In 2010, only 5% of China’s loan portfolio consisted of loans to debt-distressed countries. As of 2022, that number has skyrocketed to 60%. As Matthew Mingey from Rhodium Group stated last year: “This is the worst period of debt pressure since the start of the Belt and Road Initiative. The Covid-19 pandemic took existing problems and supercharged them.” These debts can have dire consequences for BRI participant countries. After running out of foreign reserves due to external debts of over $50 billion, Sri Lanka found itself facing grave shortages of essential goods. Zambia, once a golden child of the BRI, was forced to default on its external debt in 2020 and has gone hat-in-hand to the IMF for help.

China has received harsh criticisms of their handling of difficult debt situations, though accusations of the BRI’s “debt-trap diplomacy” have been thoroughly debunked. Very much to its credit, China has been an accommodating lender and tries to negotiate with recipient countries that have issues paying back. Of course, this isn’t done purely out of goodwill. Becoming an aggressive loan shark would undermine the BRI’s geopolitical goals of winning friends at a time when China’s public image is plummeting in most of the world. However, it has stopped short of actual loan forgiveness, only considering this option in the very worst cases where the chance of repayment is already zero.

A new report by AidData shows that China’s central bank is increasingly becoming a lender of last resort for debt-ridden countries. Almost all of this rescue lending is targeted at countries that have major debt obligations to China for its infrastructure loans. In essence, China (China’s central bank) is bailing out China (Chinese development and commercial banks) through the intermediary of BRI recipient countries—and trying to make a buck in the process by charging above-market interest rates.

Substantial loan forgiveness, the only real solution for BRI recipients’ debt troubles, would be an easier pill to swallow if China had deeper pockets. But China itself is also saddled with major debt problems. Between 2012 and 2022, China’s debt burden grew by an astonishing $37 trillion. China’s debt burden is 273% of its GDP and stands at a grand total of $52 trillion, 75% greater than the debt of all other emerging market economies combined. Debt payments have become by far the fastest growing category in China’s budget, growing by a staggering 272% in the last decade.

It is unlikely that China can simply grow its way out of its debts as it did in the late 1990’s. The days of double digit percentage GDP growth seem long gone; growth in 2022 was only 3%. China’s post-Covid 2023 will almost certainly bring a rebound, but even the CCP’s modest growth target of 5% may be difficult to reach. Local governments have already begun resorting to austerity measures to keep their debts down, further weakening growth prospects. All of this means that China is in a weak position to generously write-off BRI countries’ debts.

The Belt & Road Initiative 2.0

China is aware of these issues and has begun to acknowledge them with BRI 2.0. At the Second Belt and Road Forum in 2019, President Xi addressed the growing criticisms of the BRI. He emphasized the need for high-quality infrastructure, zero corruption, greater transparency, and commercial and fiscal sustainability. It’s still too soon to see if BRI 2.0 will make substantial improvements in these areas, but one thing is already clear: the BRI has been substantially pared down.

A study of China’s two main development banks by Boston University’s Global Development Policy Center found that lending has dropped dramatically, with a 94% fall in total lending between 2016 and 2019. As Chinese banks have grown more cautious, the size of individual projects has also been shrinking. The number of announced BRI loans worth over $1 billion has fallen from its peak of 57 in 2015 to just two in 2022. The past four years saw a fall of the average loan value by 30%, average length of linear projects dropped by 35%, and the average square footage of area-based projects shrank by a massive 82%. Disappointingly, BRI 2.0 represents a retreat from the megaprojects that defined the BRI brand and made it so inspiring in the first place. While it’s unlikely that China will completely give up the BRI, the dream presented by Xi at the BRI’s announcement is almost certainly dead.

If the BRI lives up to its moniker as “the project of the century,” the 2000s will have been a very underwhelming century indeed. With poor coordination, implementation problems, endemic corruption, labor rights abuses, and economic unsustainability, the BRI has fallen far short of its lofty goals.

It’s important nonetheless to recognize the exceedingly difficult challenge posed by such a staggering infrastructure initiative. China is not unique in suffering delays, corruption, and labor violations in infrastructure projects. Although its fragmented state bears responsibility for the BRI’s disorganization, it’s unlikely that any government today could pull off such an enormous endeavor. Creating an interconnected network of infrastructure projects across dozens of diverse countries would be challenging for even the most well-organized states.

The lesson here is thus not that the BRI vision should be discarded, but that the vision of global infrastructure interconnectivity that it laid out requires greater state capacity than China has built. This is a daunting proposition, as most states have lost such capacity during the neoliberal era. The OECD estimates that the annual global infrastructure gap is $6.3 trillion—48 times annual BRI lending. Infrastructure demand far outstrips the supply of financing, and one of the reasons that countries choose the BRI is because they simply have nowhere else to go.

The world desperately needs more infrastructure, and China should be praised for trying to provide it. But the BRI shows that if global infrastructure development is going to happen, it has to be done with strong coordination, oversight on governance and corruption, strict enforcement of labor rights, and thorough feasibility studies. The BRI has been a failure, but the dream of an ambitious international infrastructure program should be kept alive.

■

Kevin Zhang is an independent researcher of Chinese political economy and foreign policy.